【What is the impact of COVID-19?】 Merits and demerits of real estate investment in Japan (Tokyo) from the perspective of foreign investors

2020-09-24

Real Estate Investment in Japan

Many investors around the world used to say that real estate investment in Japan was “a good option to control risks and gain stable profits. Now is the time to buy properties as the Tokyo Olympic games are boosting the economy”.

Many investors around the world used to say that real estate investment in Japan was “a good option to control risks and gain stable profits. Now is the time to buy properties as the Tokyo Olympic games are boosting the economy”.

However, the Tokyo Olympic games were postponed to 2021 or could be cancelled due to COVID-19. The “corona-shock” has severely hit the Japanese economy.

In this context, is Japanese real estate still worth investing in? Let’s take a look at the situation carefully.

Firstly let’s identify the merits and demerits of real estate investment in Japan and then we’ll share with you the characteristics of properties that are selling well even under the COVID-19 situation.

4 merits of real estate investment in Japan (Tokyo)

■Japanese real estate is easy for foreigners to buy

Different countries have different regulations on purchase of real estate.

For example, countries like China, Singapore, Thailand and Philippines prohibit foreigners from owning land, while in Australia foreigners are allowed to purchase only new property or land.

On the other hand, in Japan, there are no restrictions when foreigners purchase Japanese properties, and there are no taxes specially imposed on foreigners. Even if you do not have permanent residency, you can purchase a property regardless of the type of your visa.

In other words, foreigners can own land and buildings under the same regulations as Japanese nationals, and the same goes for the cost required.

So it is a great advantage for foreigners to have an environment where it is very easy to purchase real estate.

■You can expect a higher yield (income gain) with smaller investment than in advanced Asian countries

One of the examples that Japan’s real estate investment is attractive is that in Japan, yields of 4 to 10% can be expected while those in China and Taiwan are 1 to 3%. Of course, yields in developing countries are even higher, but they pose various risks. In addition, the price range for Japanese properties is relatively affordable among developed countries, and even in central Tokyo, pre-owned studio apartments cost only less than 10 million yen. In other words, the reason why Japanese real estate investment is so popular is that it has a very good balance of benefits and risks as you can start with a small amount of investment and generate a stable yield (income gain) while mitigating risks.

■Country risk is the lowest in Asia

It is widely known that country risks in Japan are less than in most Asian countries.

Country risks typically refer to the potential losses due to fluctuations in the price of invested products or failure of wire transfers as a result of instability of the political, economic and social conditions.

According to the country risks published by the Organization for Economic Co-operation and Development (OECD), only Singapore and Japan have the highest A ranks in Asia (As of July 2020).

In other words, you can say the risk of the price of Japanese investment properties plunging is quite limited.

■Properties in Tokyo are easy to sell

Second-hand studio apartments in central Tokyo are reasonably priced at 10 to 30 million yen and are very popular among Japanese investors. Since such properties are marketable, you can easily buy and sell. You can hedge risks by owning multiple studio apartments.

3 demerits of real estate investment in Japan (Tokyo)

Even though Japan is generally regarded as an attractive investment destination, it also has some demerits. You had better have a good understanding of them and so you can be well-prepared.

■There are risks of natural disasters (earthquakes, floods, etc.)

Japan has experienced many earthquakes among other countries. We have witnessed many properties destroyed by major earthquakes in the past. However, Japan’s long-standing experience with earthquakes has actually helped us develop excellent building technologies with great earthquake resistance.

One of the common features of the properties destroyed by major earthquakes is that they were wooden buildings built before 1981. In 1981, the Japanese “Building Standards Law” was amended with new seismic standards created. Consequently, the properties built after June 1981 can withstand seismic intensity of 6 to 7 (the highest level of shaking).

In other words, as a point for selecting properties in Japan, we recommend that you target the properties built in and after 1981 and with an RC structure (reinforced concrete structure) with strengthened earthquake resistance.

It is even safer to have earthquake insurance at the time of purchase of Japanese real estate.

■ Japan’s declining population

One of the existing challenges in Japan is the issue of “declining birthrate and aging population”. Because of this issue, some people fear that the vacancy rate will increase as the population decreases.

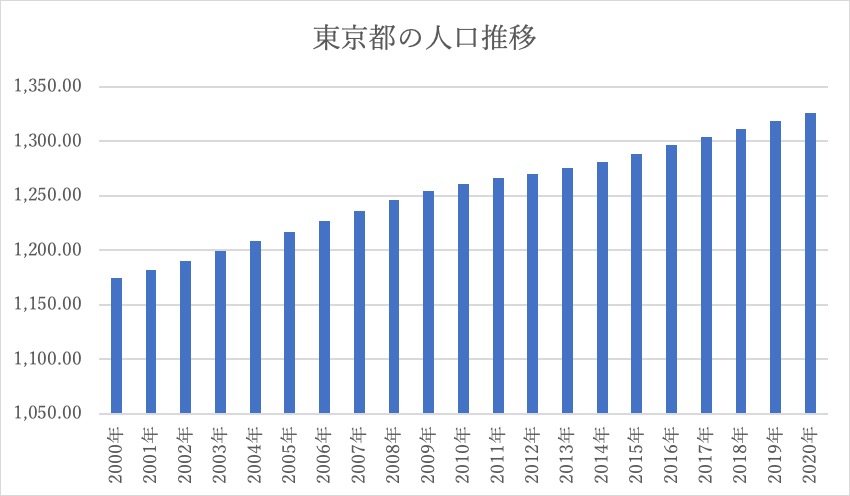

However, while the population of Japan is decreasing as a whole, the number of households and the population in the Tokyo area are increasing due to the population inflow from rural areas and the increase of foreign immigrants. In other words, a large part of the population is concentrated in Tokyo while that in the local areas declines.

With that in mind, it would be better to buy real estate in Tokyo, where there are good prospects for the demand for rental properties rather than in a local area with higher yields but also higher vacancy risks involved.

■It is difficult to obtain information on Japanese investment properties

There are many real estate agents and information websites for Japanese investors, but very few companies provide multilingual property information for foreign investors. In addition, you can rarely find the companies that can provide a one-stop service including rental management and advertisement after the purchase of a property.

To solve these problems, Wagaya Japan offers a one-stop service in multiple languages. We provide total support from the purchase to rental management, advertisement, as well as the sale of the property.

Characteristics of properties that sell well even under the COVID-19 situation

The demand for offices in central Tokyo is declining due to COVID-19. Especially IT start-up companies are actively shifting to teleworking (working from home), and recently more and more office tenancies in central Tokyo are being cancelled. If this trend takes hold in the future, there will be an increase in the vacancy rate of offices in Tokyo as well as the risk of lower rents.

On the other hand, although the demand for housing has temporarily dropped due to the “Emergency Declaration” in Tokyo, it turned around in July 2020, and since then we have seen active real estate transactions.

The areas where stable demand can be expected even under the COVID-19 situation are near the main stations on the Tokyo JR Yamanote Line as well as the areas around the popular stations where express trains stop.

And because of the declining birthrate, the aging population and the increase in the number of foreign immigrants, rooms for singles are preferred over large floor plans for families.

If we carefully select these points while choosing properties, we may be able to make effective real estate investments without being affected by COVID-19.

Summary

The Japanese real estate market is a very attractive investment destination for foreign investors. Particularly in Tokyo, although property prices soared for a period of time due to a temporary boom caused by the Tokyo Olympics, stable prices and yields should be expected going forward.

In order to minimize concerns in real estate investment, it is important to fully understand the merits and demerits of purchasing real estate investment properties in Japan and remember to focus on (1) the areas to purchase, (2) the building structure, and (3) the age.

At Wagaya Japan, a staff of various nationalities provides a wide range of free support including consultation on property purchase and sales in the language of your choice such as English and Chinese. Please feel free to contact us.